Homeownership Made Easy: Expert Assistance for Home Buyers!

Let’s embark on a journey together where we’ll delve into the essential steps of the mortgage application, demystify the home purchase process, and discuss the pre-approval phase.

The Purchase Process

Mortgage Application Sections

- The consumer’s name(s)

- The consumer’s income(s)

- The consumer’s Social Security number to obtain a credit report (or other unique identifier if the consumer has no Social Security number)

- The property address: TBD

- An estimate of the value of the property

- The mortgage loan amount sought

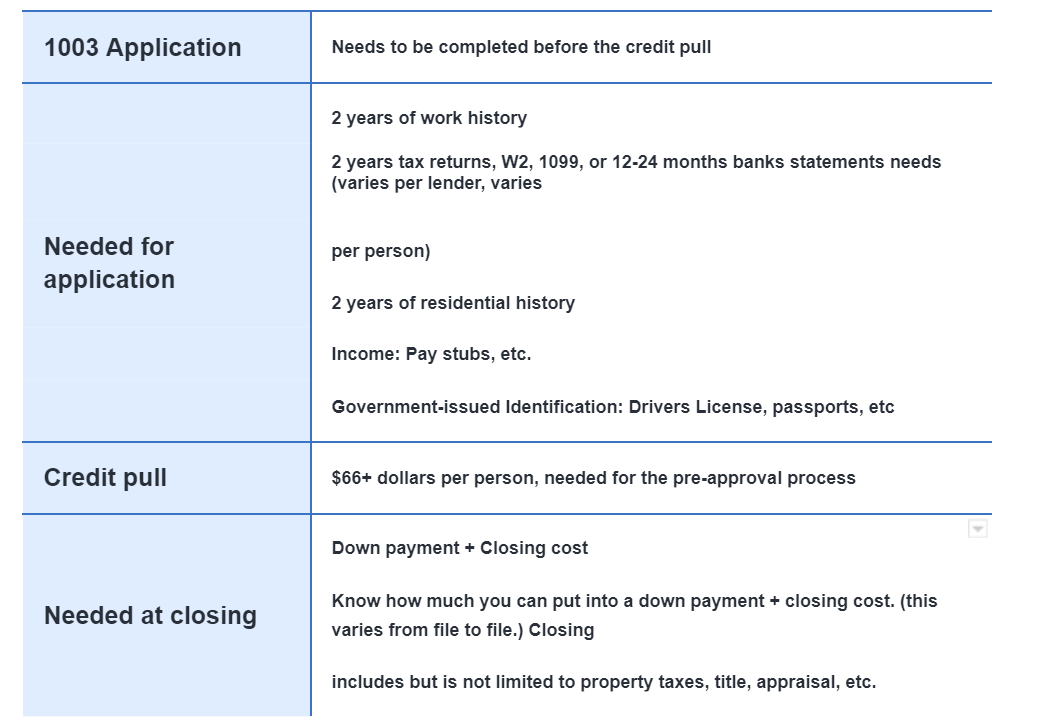

Home Purchase Process

Understanding the home buying process. Closing on a loan takes time, closing takes 14-45 days, depending on how clean a file is. Every financial portfolio is based on the verification of income, assets, and credit history.

There are a variety of loans to fit everyone’s financial situation, every financial portfolio is different.

Pre-Approval

After the credit pull, income calculations and fund verifications have been completed, we will know how much you are approved to borrow.

If you have someone in mind who would find this information valuable, I kindly encourage you to hit the share button. Together, we can empower others on their journey towards informed decision-making and homeownership success. Thank you for spreading the word!

Original Article: https://themortgageivy11.substack.com/p/homeownership-made-easy-expert-assistance?r=2bzxfg